Trending

Phase out I-T cess, ensure small states get priority when funds are disbursed: GCCI

GCCI, in its letter to the chairman of the 16th Finance Commission, Arvind Panagariya, said that an increase in tax devolution will benefit small states like Goa, which have limited resources.

GCCI has also said that small states like Goa should be given priority when Centre disburses funds and grants for schemes.

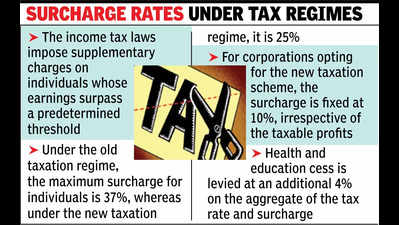

The proceeds of cesses and surcharges do not form part of the divisible pool of taxes, and hence the cess collected, which is estimated at more than 20% of the total tax collected, is not shared with states.

“As a result, the share of tax devolution in the gross tax revenue of Centre has been much lower than the recommended tax devolution. This in turn encourages states and local bodies to levy their own open-ended cesses to increase their own revenue,” said GCCI director general Sanjay Amonkar.

“The impact of all these cesses is borne by the taxpayers, which includes the salaried class as well as private sector firms.”

GCCI said that phasing out open-ended cesses and surcharges will not only reduce the financial burden on taxpayers but will also help simplify tax laws.

Amonkar said there is no clarity about the cut-off for the cesses or a target to achieve the objectives that the cesses aim to achieve.

“Cesses and surcharges are meant to be levied sparingly to meet a specific requirement and are generally mandated for a temporary period. However, it has been observed that there has been an increase in the rates over the years,” said Amonkar.

Finance minister Nirmala Sitharaman has called for a review of the Income Tax Act within the next six months to simplify taxation. She announced that the indirect tax rates may be rationalised.

“This is the right time to abolish cesses and surcharges that have been present for many years. This in turn will decrease the overall tax rates for individuals and corporates, and bring about tax certainty, which is a cornerstone to the ease of doing business,” said Amonkar.

Amonkar also said cesses should be imposed only as a last resort and for a defined purpose.

End of Article

FOLLOW US ON SOCIAL MEDIA