- News

- Business News

- India Business News

- Are NPS Vatsalya & hiked NPS deduction limit for private sector employees good moves from Budget 2024? Experts decode

Trending

Are NPS Vatsalya & hiked NPS deduction limit for private sector employees good moves from Budget 2024? Experts decode

In the Union Budget 2024, Finance Minister Nirmala Sitharaman introduced two initiatives: extending NPS 14% employer contribution benefits to the private sector and announcing NPS Vatsalya.

Budget 2024 announced the hiking of the tax deduction limit on private sector employers’ contributions to NPS from 10% to 14% of employees’ basic salaries. (AI image)

Latest NPS rules, news: In the Union Budget 2024 speech, Finance Minister Nirmala Sitharaman announced two new initiatives with regard to National Pension Scheme (NPS) - extension of NPS 14% employer contribution benefits to private setcor and the intended launch of NPS Vatsalya.

Budget 2024 announced the hiking of the tax deduction limit on private sector employers’ contributions to NPS from 10% to 14% of employees’ basic salaries, bringing it at par with the provisions available for government employees.

Sriram Iyer, CEO, HDFC Pension Management told ET that with this move the “ground rules have been harmonised among government and non-government employees, which is a positive step.”

Effectively, this means that now, private-sector employees can choose to reduce the taxable portion of employers’ contribution to their NPS corpus, thereby paying less tax and leaving greater funds in their pension deposits.

“Employees will benefit from tax savings. More importantly, the 40% increase in contribution will have a significant impact on the terminal value of the retirement corpus,” remarked Iyer. The extended savings will “help in retirement planning, working as an option that is at par with the Provident Fund,” Dinesh Rohira, CEO & Founder, 5nance.com was quoted as saying.

Moreover, the endeavour aims to increase NPS penetration by increasing tax incentives for the private sector, providing them a social security-cushion post-retirement.

The scheme’s motive to widen the NPS subscriber base may not prove to be flawlessly effective, however. This is explained by Agrees Mrin Agarwal, Founder, Finsafe India: “While it’s good that the limit has been raised, it may not increase adoption as employees need to be educated in a big way. Also, the benefit is only for the salaried opting for the new tax regime,” she says.

The mandatory contribution to the EPF, too, threatens to relegate the provisions of NPS under the umbrella of near-superfluity. This sentiment is echoed by Varun Sahay, a software engineer in a Delhi-based IT company: “When 12% of my salary is already deducted for the EPF, why should I put in more in the NPS and cut my take-home pay?”

Rohira feels otherwise. “There’s no competition between the NPS and EPF as employees can contribute to both and build a 3-4 times bigger corpus while earning 3-4% higher returns via marketlinked options in the NPS,” he counters.

Also Check | New Tax Regime 2023 vs 2024 After Budget: How Much Income Tax Will Salaried Taxpayers Save & How Do New Tax Slabs Compare To Old Regime? Top 10 Points You Must Know

To jumpstart retirement savings for children, a new initiative called NPS Vatsalya has been unveiled in the Budget. This scheme allows parents and guardians to contribute to a minor's account, which can be converted into a regular NPS account once the child reaches adulthood.

"It provides a very long duration for reaping the compounding benefits and accumulating a huge bounty at a later age. This can be a good way to plan a better future for kids who may not opt for a service segment in the future," says Rohira. Sriram Iyer agrees, stating, "It’s a good move to help the child start his retirement journey. Even if a parent starts when the child is 10 years old, by the time he starts working, it can be a solid foundation for the compounding journey after that."

However, some experts question the utility of a product with such a long lock-in period, especially when parents cannot use the funds for essential goals like their child’s education amidst soaring education costs of 11-12%.

"Parents are struggling to save for their own retirement, so it might be a bit of a stretch to expect them to save for their kids’ retirement. The need of the hour is a market-linked product that allows withdrawals only for the child’s education," says Mrin Agarwal, Founder of Finsafe India.

Also Read | Latest NPS rules 2024: How much tax will you save with new NPS contribution benefit under new regime after Budget 2024?

Though the NPS permits partial withdrawals, it allows only 25% of the corpus after three years of joining, and this can be done only three times during the entire tenure. A premature exit before 60 years with 100% withdrawal is only possible if the corpus is less than Rs.2.5 lakh, an amount insufficient for most children's goals.

"In its current form, there won’t be any uptake," asserts Agarwal. Rohira concurs, "It’s a vanilla product with a lock-in, which does not make it very attractive and it may not take off. However, the government may optimise it and introduce new features later." Iyer adds, "This is just a start and there may be more subscriber-friendly features as we take it to the market. The regulator is proactive and open to feedback."

Budget 2024 announced the hiking of the tax deduction limit on private sector employers’ contributions to NPS from 10% to 14% of employees’ basic salaries, bringing it at par with the provisions available for government employees.

Sriram Iyer, CEO, HDFC Pension Management told ET that with this move the “ground rules have been harmonised among government and non-government employees, which is a positive step.”

Effectively, this means that now, private-sector employees can choose to reduce the taxable portion of employers’ contribution to their NPS corpus, thereby paying less tax and leaving greater funds in their pension deposits.

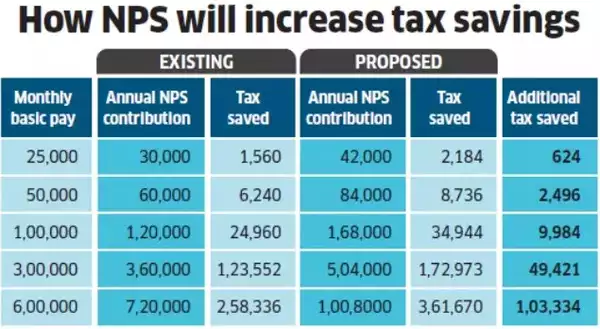

How NPS will increase tax savings

“Employees will benefit from tax savings. More importantly, the 40% increase in contribution will have a significant impact on the terminal value of the retirement corpus,” remarked Iyer. The extended savings will “help in retirement planning, working as an option that is at par with the Provident Fund,” Dinesh Rohira, CEO & Founder, 5nance.com was quoted as saying.

Moreover, the endeavour aims to increase NPS penetration by increasing tax incentives for the private sector, providing them a social security-cushion post-retirement.

The scheme’s motive to widen the NPS subscriber base may not prove to be flawlessly effective, however. This is explained by Agrees Mrin Agarwal, Founder, Finsafe India: “While it’s good that the limit has been raised, it may not increase adoption as employees need to be educated in a big way. Also, the benefit is only for the salaried opting for the new tax regime,” she says.

NPS and EPF: Overlapping services

The mandatory contribution to the EPF, too, threatens to relegate the provisions of NPS under the umbrella of near-superfluity. This sentiment is echoed by Varun Sahay, a software engineer in a Delhi-based IT company: “When 12% of my salary is already deducted for the EPF, why should I put in more in the NPS and cut my take-home pay?”

Rohira feels otherwise. “There’s no competition between the NPS and EPF as employees can contribute to both and build a 3-4 times bigger corpus while earning 3-4% higher returns via marketlinked options in the NPS,” he counters.

Also Check | New Tax Regime 2023 vs 2024 After Budget: How Much Income Tax Will Salaried Taxpayers Save & How Do New Tax Slabs Compare To Old Regime? Top 10 Points You Must Know

What is NPS Vatsalaya?

To jumpstart retirement savings for children, a new initiative called NPS Vatsalya has been unveiled in the Budget. This scheme allows parents and guardians to contribute to a minor's account, which can be converted into a regular NPS account once the child reaches adulthood.

"It provides a very long duration for reaping the compounding benefits and accumulating a huge bounty at a later age. This can be a good way to plan a better future for kids who may not opt for a service segment in the future," says Rohira. Sriram Iyer agrees, stating, "It’s a good move to help the child start his retirement journey. Even if a parent starts when the child is 10 years old, by the time he starts working, it can be a solid foundation for the compounding journey after that."

However, some experts question the utility of a product with such a long lock-in period, especially when parents cannot use the funds for essential goals like their child’s education amidst soaring education costs of 11-12%.

"Parents are struggling to save for their own retirement, so it might be a bit of a stretch to expect them to save for their kids’ retirement. The need of the hour is a market-linked product that allows withdrawals only for the child’s education," says Mrin Agarwal, Founder of Finsafe India.

Also Read | Latest NPS rules 2024: How much tax will you save with new NPS contribution benefit under new regime after Budget 2024?

Though the NPS permits partial withdrawals, it allows only 25% of the corpus after three years of joining, and this can be done only three times during the entire tenure. A premature exit before 60 years with 100% withdrawal is only possible if the corpus is less than Rs.2.5 lakh, an amount insufficient for most children's goals.

"In its current form, there won’t be any uptake," asserts Agarwal. Rohira concurs, "It’s a vanilla product with a lock-in, which does not make it very attractive and it may not take off. However, the government may optimise it and introduce new features later." Iyer adds, "This is just a start and there may be more subscriber-friendly features as we take it to the market. The regulator is proactive and open to feedback."

End of Article

FOLLOW US ON SOCIAL MEDIA