- News

- Business News

- India Business News

- UltraTech to buy building materials business of Kesoram in 7,600 crore deal

Trending

This story is from December 1, 2023

UltraTech to buy building materials business of Kesoram in 7,600 crore deal

Kumar Mangalam Birla's UltraTech Cement will buy the building materials business of Kesoram Industries (KI) - a company owned by his aunt Manjushree Khaitan - for an enterprise value of Rs 7,600 crore, consolidating the billionaire's position in the country amid major expansion plans by Gautam Adani for Ambuja Cements. Kesoram Cement, which will give Birla a manufacturing facility in Telangana, also accelerates UltraTech's plans to achieve a capacity of 200 million tonnes in the country.

MUMBAI/KOLKATA: Kumar Mangalam Birla's UltraTech Cement will buy the building materials business of Kesoram Industries (KI) - a company owned by his aunt Manjushree Khaitan - for an enterprise value of Rs 7,600 crore, consolidating the billionaire's position in the country amid major expansion plans by Gautam Adani for Ambuja Cements.

Kesoram Cement, which will give Birla a manufacturing facility in Telangana, also accelerates UltraTech's plans to achieve a capacity of 200 million tonnes in the country.

"It's a win-win for the industry - as assets moving from weaker hands to stronger is a national gain on productivity and for shareholders of both UltraTech and Kesoram Industries. It is better value of money for UltraTech shareholders and Kesoram Industries gets a good value for its shares," said Anil Singhvi, founder of advisory firm Ican Investment.

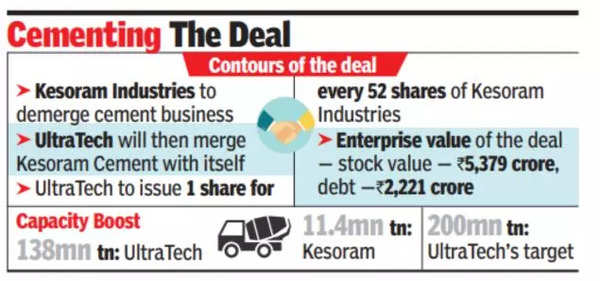

The Rs 7,600-crore enterprise value includes an equity value of Rs 5,379 crore and debt of Rs 2,221 crore. The transaction implies an offer price of Rs 173 a share - a 34% premium to KI's last close of Rs 140.

KI's cement business, which has two manufacturing facilities in Karnataka (10.75 million tonnes) and Telangana (0.66 million tonnes), and a packing plant in Maharashtra, had a turnover of Rs 3,518 crore in FY23. The acquisition will augment the capacity of UltraTech, the world's third largest cement producer outside of China, to 149 million tonnes from the existing 138 million tonnes. Adani is targeting a capacity of 140 million tonnes.

The cement business formed 99.5% of KI's turnover. The sale will help KI to focus on its rayon, transparent paper and chemicals businesses.

Kesoram Cement, which will give Birla a manufacturing facility in Telangana, also accelerates UltraTech's plans to achieve a capacity of 200 million tonnes in the country.

In August, Adani added heft to his cement capacity through the Rs 5,000-crore acquisition of Sanghi Industries.

"It's a win-win for the industry - as assets moving from weaker hands to stronger is a national gain on productivity and for shareholders of both UltraTech and Kesoram Industries. It is better value of money for UltraTech shareholders and Kesoram Industries gets a good value for its shares," said Anil Singhvi, founder of advisory firm Ican Investment.

The contours of the deal include KI first separating the cement business from itself and then merging it with UltraTech. Birla will issue one share of UltraTech to KI's shareholders for every 52 shares held by them in consideration for the demerger and amalgamation. The share allocation will increase UltraTech's equity capital and as a result, Birla's stake will fall by a tiny 0.8% from the current 59.96% in the company.

The Rs 7,600-crore enterprise value includes an equity value of Rs 5,379 crore and debt of Rs 2,221 crore. The transaction implies an offer price of Rs 173 a share - a 34% premium to KI's last close of Rs 140.

KI's cement business, which has two manufacturing facilities in Karnataka (10.75 million tonnes) and Telangana (0.66 million tonnes), and a packing plant in Maharashtra, had a turnover of Rs 3,518 crore in FY23. The acquisition will augment the capacity of UltraTech, the world's third largest cement producer outside of China, to 149 million tonnes from the existing 138 million tonnes. Adani is targeting a capacity of 140 million tonnes.

The cement business formed 99.5% of KI's turnover. The sale will help KI to focus on its rayon, transparent paper and chemicals businesses.

End of Article

FOLLOW US ON SOCIAL MEDIA