- News

- City News

- mumbai News

- Cyber scam 2.0: Fake cops ‘detain’ well-heeled in Mumbai hotels, extort crores

Trending

Cyber scam 2.0: Fake cops ‘detain’ well-heeled in Mumbai hotels, extort crores

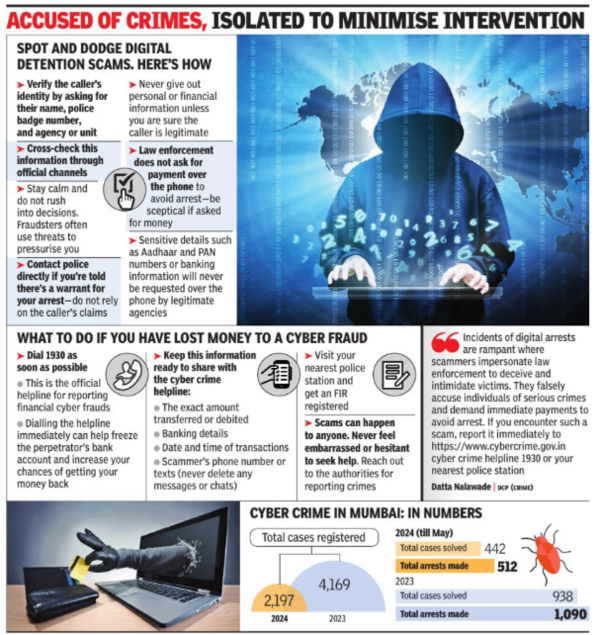

In Mumbai, a senior executive lost Rs 2 crore to scammers who posed as crime branch officers and isolated him in five-star hotels for nine days. Using fake legal documents and threats, they coerced him into transferring the money. This case reveals a new scam tactic called 'hotel detentions,' targeting affluent individuals.

A senior executive in Mumbai fell victim to a sophisticated scam, losing Rs 2 crore after being isolated in five-star hotels for nine days by fraudsters posing as crime branch officers.

The men spun an elaborate web of lies, accusing the executive of money laundering and human trafficking, complete with fake legal documents.

This incident is part of a disturbing new trend where scammers are employing the tactic of "hotel detentions" to deceive and defraud unsuspecting victims. By isolating their victims in hotels, they can ensure complete control and minimise the chances of intervention from loved ones. This marks a significant upgrade from earlier methods, where victims were confined to their own homes.

The executive's ordeal began with a phone call claiming his couriered parcel had been intercepted by the parcel department. He tried to explain that he hadn't sent any parcel, but the caller claimed that his Aadhaar number was linked to the parcel. Despite his explanations, he was connected to one inspector Vikram Singh "from the crime branch"—who he later learned was a conman. Singh made a video call to the executive, dressed in khaki uniform. He was later joined by "a colleague", Vineet Rathi. Accusing the executive of money laundering and trafficking, they said that he had been placed under "house arrest". Subsequently, they instructed him to move to a five-star hotel and threatened him with physical arrest if he spoke to anyone.

The executive changed hotels twice over the next nine days. He later told investigators that the scammers switched off their video cameras but forced him to keep his camera on and constantly surveilled him. He was connected to an "RBI official" Anand Rane—who was also part of the scam. Rane sent him fake documents—ranging from a Bombay high court writ petition to a letter from the Reserve Bank of India (RBI) addressed to him. Convinced that his wealth was under scrutiny by the RBI, the executive deposited Rs 2 crore into a bank account that he was told was being monitored by the central bank.

Experts said these scams are becoming increasingly sophisticated, targeting well-heeled individuals who are more likely to be intimidated by threats of legal repercussions. "By manipulating their victims' emotions, scammers convince them to believe false accusations and comply with their demands. Unlike those with nothing to lose, well-educated and wealthy individuals are more concerned about their reputation, making them susceptible to manipulation," said cyber security consultant Venkata Satish Guttula.

In another incident, a suburban resident lost Rs 1 crore after being intimidated by scammers that his SIM card would be blocked for illegal activity. He was asked to move to a hotel for five days and not contact his family. He was required to frequently share his GPS location with the conmen, who claimed that the Enforcement Directorate (ED) would carry out a probe in the case.

"Cyber criminals are constantly evolving their tactics," said cyber security trainer Nikhil Mahadeshwar. "As soon as their old tricks are exposed, they devise new ones to make their scams seem more authentic."

In a latest incident, a woman similarly asked to stay at a hotel was forced to strip before the camera for a "body inspection as part of a confidential inquiry" by cyber scammers. When she wouldn't pay more than Rs 50,000, the fraudsters threatened her with images of her undressing before the camera.

"Victims of these scams are often unfamiliar with the legal system and have had no prior experience dealing with the police," said Mahadeshwar. "Their desire for a quick resolution makes them more vulnerable to fraudsters' tactics," he added. Mahadeshwar advised against posting personal information on social media and suggested making user accounts private to reduce the risk of being targeted by scammers.

Guttula added that cyber-security awareness campaigns needed to be as widespread as the Pulse Polio Campaign, reaching millions of people. "These campaigns should also be more detailed. Instead of general advice like ‘don't click on suspicious links', they should explain how to identify suspicious links and who to contact in case of fraud," he said.

End of Article

FOLLOW US ON SOCIAL MEDIA